Bühler presented its annual results showing robust business performance in 2020. Protection of the health of employees, securing supply chains for customers and keeping the innovation rate high were top priorities.

Despite adverse conditions, the company fulfilled all customer contracts and delivery agreements without interruptions. The company also launched major innovations for key markets. The group gained additional financial strength, with equity ratio reaching 44.2% (+1.4 percentage points) and net liquidity soaring to CHF 749 million (+66.8%). Turnover was CHF 2.7 billion (-17.0%), with order intake amounting to CHF 2.6 billion (-16.7%). “With high agility, we adapted quickly to the new situation to ensure continuity on all levels,” says CEO Stefan Scheiber. “In light of our global set-up and innovation power, we are looking into the future with bounded optimism.”

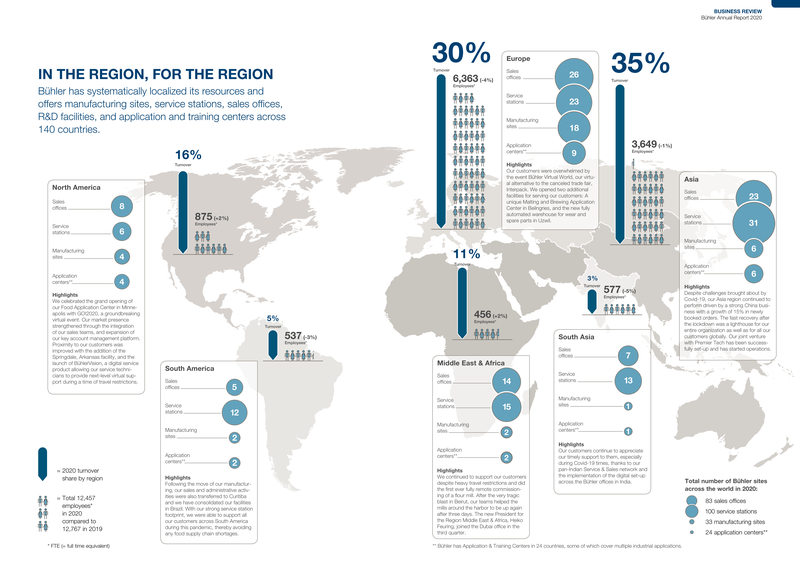

Bühler assured the health of its employees and its daily operations throughout the year. Supply chains proved remarkably solid, as the company was able to absorb the pandemic’s waves thanks to its global network of 33 factories, 100 service stations and digital tools such as remote customer trials or commissioning, to bring much-needed food capacities online worldwide. “We have seen a sharp rise in customer demand for digital solutions but also sustainable solutions, such as CO2-reduced emissions, nutritious and healthy food, high-end deposition technologies, and clean mobility,” said Scheiber.

Increased financial strength

“Protecting our liquidity had the highest priority over last year,” said CFO Mark Macus. “Our target was to remain a very solid and strong partner for all our stakeholders, and we achieved this even in a challenging year like 2020.” Driven by diligent finance management, operating cash flow jumped 211% from CHF 151 million to CHF 470 million. Strict cost management allowed Bühler to offset a significant part of the adverse volume impact, resulting in EBIT of CHF 146 million (previous year: CHF 248 million), and an EBIT margin of 5.4% (7.6%).

Robust business performances

Grains & Food (GF) proved resilient and agile, with very solid business performance. Order intake was CHF 1.6 billion, 13.9% lower than the previous year. Turnover decreased 7.2% to CHF 1.7 billion. With the implementation of innovative solutions such as Mill E3 and its Arrius integrated grinding system, GF further expanded its position as a technological leader in grain processing and human and animal nutrition.

Success in China mitigated low volumes in other regions

Along with the divergent course of Bühler’s businesses, there was also a shift in regional development towards Asia. While all markets reported lower volumes, Bühler Asia managed to be stably driven by the strong growth of Bühler’s business in China. Order intake in China rose sharply by 15% for the full year. Regarding turnover, Asia now makes up 35% (previous year: 31%), Europe 30% (30%), North America 16% (16%), Middle East & Africa 11% (14%), South America 5% (6%) and South Asia 3% (3%).

Continuation of the innovation roadmap

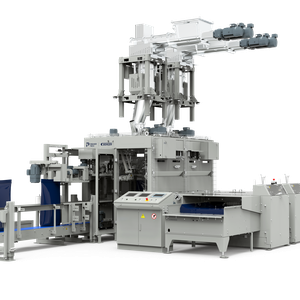

Despite the challenging environment, Bühler continued to execute its innovation roadmap, launching 86 new products and solutions. The expenses for research and development were about at last year’s level at CHF 139 million (previous year: CHF 149 million), leading to an increase relative to Group turnover of 5.2% (previous year: 4.6%). Bühler opened new application centers for food in Minneapolis, US, for malting and brewing in Beilngries, Germany, and a new training and education center for cocoa processing in Abidjan, Cote-d’Ivoire. With Givaudan, the global leader in flavors and fragrances, Bühler built an Innovation Center dedicated to plant-based foods in Singapore. The new facility plans to open in March 2021. With Canadian Premier Tech, Bühler formed a joint venture in China for new packaging solutions which started very successfully in 2020. Furthermore, Bühler drove the latest innovations for digital platforms and solutions successfully into industrial applications globally with impressive success.

All innovation efforts of Bühler are aligned to the company’s commitment to lower energy use, water consumption, and waste in the value chains of its food, feed and mobility customers by 50% until 2025.

“For 2021, we expect our business volume and profitability to stay stable, as the coronavirus crisis will have a longer-lasting effect on our businesses. At the same time, we are now laying ground to return to profitable growth in the future, by addressing new markets and adapting to new market conditions and opportunities with agility and determination,” said Scheiber.

For more information on Bühler annual report, visit www.buhlergroup.com.