Rabobank’s recently published 2021 World Seafood Map shows that the global seafood trade rebounded strongly in 2021, driven by growing demand for high-value seafood in the US, EU, and China.

This rising demand for fishery and aquaculture products has positioned seafood as the most traded animal protein, with an estimated trade value of USD 164 billion in 2021 and a 2.44% CAGR (2011-2021). Nearly half of that trade flowed to the EU, the U.S., and China, whose combined imports in 2021 surpassed USD 80 billion.

In 2021, the seafood trade was roughly 3.6 times the size of the beef trade (the second most traded animal protein), five times the size of the global pork trade, and eight times the size of the poultry trade, signifying the importance of trade for the seafood sector. With over 55 trade flows each valued over USD 400 million a year and an additional 19 trade flows valued between USD 200 million and USD 400 million each, seafood isn’t only an important source of protein for food security, it’s an important source of income in many economies.

“Developing countries play a major role in seafood exports, accounting for seven of the top 10 exporters, and developed countries are increasingly reliant on developing nations for imports of high-value species, especially shrimp from India and Ecuador and salmonids from Chile,” said Novel Sharma, seafood analyst at Rabobank.

High-value species will drive seafood trade growth

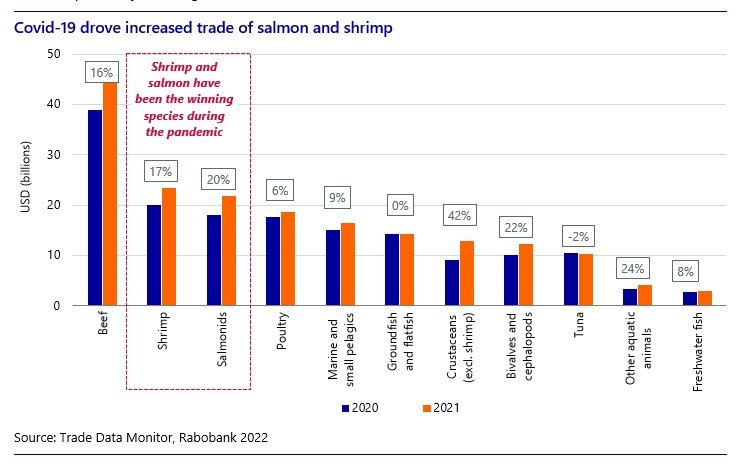

Since 2013, the winners of the global seafood trade have been high-value species, such as shrimp and salmonids, and the pandemic strengthened this trend. “During the pandemic, we saw higher-value proteins such as beef, shrimp, and salmonids outperform other proteins, with year-on-year growth in the trade value of 16%, 17%, and 20%, respectively,” said Gorjan Nikolik, senior seafood analyst at Rabobank. “We are also seeing unprecedented high prices for many seafood species due to challenges in international trade such as rising freight and energy costs and continued lockdowns in China. However, recent data suggests the impact on seafood demand may become material, especially if a recessionary environment develops in the second half of 2022 or 2023. This could affect seafood market prices and the value of trade flows.”

In the coming years, the authors expect sustainability and demand for healthful and premium species to continue driving trade volumes of high-value seafood. Exporters, such as India and Ecuador, are well positioned to capitalize on emerging trends and close the gap in the exporter rankings.