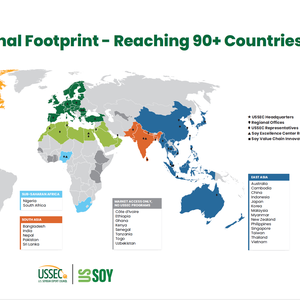

West Africa, a region with a deep cultural connection to fish consumption, is undergoing a profound transformation in its food production landscape. Faced with a widening gap between fish supply and demand, and a heavy reliance on imports, nations like Côte d'Ivoire, Ghana, and Nigeria are implementing strategic programs to bolster their domestic aquaculture industries.

Driving aquaculture growth in Côte d’Ivoire

“It is clear now that we are making real progress in aquaculture,” said Jean-Paul Amoako, a fish farmer, at SELAB Fisheries Expo, Côte d’Ivoire’s first international fisheries event, held at the Sofitel Abidjan Hotel, in Abidjan. “Three international fish feed companies, Aller Aqua, de Heus/Koudjis and Raanan, have all had a presence here. Koudjis has opened a large factory here and we have seen sizable delegations from important aquaculture nations like Egypt and Malaysia. We will use this as an opportunity to take our industry to a much higher level.”

Like their Ghanaian neighbors, Ivorians consume a substantial amount of fish, about 23.5 kilos per capita, compared to 12 kilos of meat. As in Ghana, marine fish catches have declined over time, leaving a wide gap between supply and demand. According to the FAO, Côte d’Ivoire’s current annual fish production stands at 110,000 tons, while demand reaches 600,000 metric tons. The shortfall is met through imports, which amounted to USD 840.7 million in 2023. Sixty percent of the country’s fish farming is done in dams, and 40% in ponds.

An ambitious program aimed at long-term transformation of the aquaculture industry was launched in August, 2022 by Prime Minister Patrick Achi. The Strategic Programme For The Transformation of Aquaculture in Cote d’Ivoire (PSTACI) is valued at F.CFA 825 billion. One of its primary goals is to reduce the country’s frozen fish import bill, which stood at USD 476.7 million—then the nation’s single largest import. The program aims to produce 500,000 metric tons of tilapia and catfish by 2031. Investment priorities include enhancing broodstock, establishing disease monitoring facilities, building fish feed factories, and improving transportation and distribution infrastructure.

With FAO support under the FISH4ACP program, Côte d’Ivoire is also targeting an increase in annual tilapia production to 68,000 metric tons by 2031. One of the program’s priorities is to improve the availability of both tilapia fingerlings and quality feed. Currently, the country imports around 50,000 tons of tilapia annually.

Additionally, the Project For The Development of Competitive Value Chains In Aquaculture and Sustainable Fisheries, a five-year initiative worth USD 25.6 million and funded by the African Development Bank, is set to launch in June. The project will support efforts to increase broodstock capacity, establish hatcheries, scale up commercial fry production, and produce high-quality feed, all aimed at accelerating aquaculture growth over the next five years.

During a workshop at the SELAB Expo, FAO consultant Pierre-Phillipe Blanc noted that Côte d’Ivoire still has work to do to scale up aquaculture. “The country consumes over 600,000 tons of fish annually, but aquaculture currently contributes only 8,000 to 10,000 tons,” he said. “Aquaculture must be supported by the government and treated as a priority,” citing the nation’s high fish consumption and growing import bill.

Pierre-Phillippe Blanc at a workshop during SELAB Fisheries Expo. Credits: Efua Konyim Okai

The presence of multiple international fish feed companies reflects strong expectations for growth in the Ivorian aquaculture sector. Tilapia production is projected to rise to meet increasing demand, especially in urban areas. Like many West African countries, Côte d’Ivoire boasts a variety of traditional dishes made with smoked, salted, and dried tilapia. In urban centers, Poisson Braisé, grilled tilapia stuffed with vegetables and spices and served with attiéké, is a particularly popular delicacy.

Optimizing Heterotis production in Ghana

The African bony-tongue (Heterotis niloticus) freshwater fish holds significant promise for aquaculture in Africa, known for its flesh quality, rapid growth, and tolerance for low-oxygen environments. However, its widespread deployment has been limited by high mortality rates between the larval and fry stages, often attributed to insufficient nutrition and handling stress.

Researchers at the Department of Fisheries and Watershed Management at Kwame Nkrumah University of Science and Technology have been working to improve performance during these critical early stages. Recently, they conducted another study testing different weaning diets.

The researchers evaluated the survival and growth performance of H. niloticus fry, weaned at 40 days post-hatching, on three formulated pelleted diets with varying crude protein content, a commercial fry feed, and a control group maintained on live Artemia nauplii. They found that while the pelleted feeds resulted in poor survival rates, co-feeding with Artemia nauplii during the weaning stage led to low mortality rates. This indicates that "the fry of H. niloticus require a longer adaptation period to dry feeds," researchers concluded.

The Department is actively conducting training sessions directly with fish farmers involved in farming Heterotis to disseminate these research findings. Following a recent engagement at the Fisheries Commission auditorium in Kumasi, Professor Daniel Adjei Boateng, the principal investigator, stated that the new information shared with farmers "included guidance on how to properly handle fish, the appropriate stages at which to harvest them, and best practices for preparing the fry for transportation." A notable number of farmers are adopting these new practices, and it is anticipated that with this "spell of unproductivity" broken, commercial Heterotis production will soon have a major impact on Ghanaian aquaculture.

Farmers at Heterotis workshop. Credits: Efua Konyim Okai

Nigeria: An emerging tilapia giant?

Following the signing of an agreement in March 2022 between WorldFish and Premier Aquaculture Ltd, 60,000 Genetically Improved Tilapia (GIFT) fry were transferred from WorldFish headquarters in Malaysia to Premier Aquaculture’s quarantine facility in Ogun State, to start a GIFT-based tilapia industry in Nigeria. This initiative faced some disagreement from local industry stakeholders, who voiced concerns about the lack of consultation, particularly regarding the selection of a locally-based Indian company.

Despite initial objections, the introduction of this strain has led to significant improvements in yield, contributing to increased tilapia output and fostering hopes that tilapia will become a major component of Nigerian aquaculture.

At the WorldFish Pitch Your Business Concept event in May of last year, Lasisi Nurudeen, Country Manager of Aller Aqua Nigeria, expressed optimism about the future of tilapia production. He estimated Nigeria's tilapia production in 2023 at 50,000 metric tons. These impressive figures, he explained, were primarily produced by Premium Aquaculture in Ogun State, Kainji Aquaculture in Niger State, Mira Farms, and various smaller farms in Lagos State. Nurudeen projected a doubling of production by 2028, which would create a feed demand where Aller Aqua's share is anticipated to be 54,500 tons (38%).

According to a WorldFish document authored by Eunice Ayo Aderele on April 11, 2025, "farmers reported that GIFT tilapia reached an average weight of 600g within six months, demonstrating the species' rapid growth. Inspired by this success, many farmers are restocking their ponds, contributing to sustainable growth in tilapia farming across Nigeria".

Currently, catfish accounts for at least 80% of Nigerian aquaculture, with most farmers operating at a micro level. Nigeria annually imports 3.6 million tons of fish, valued at USD 1.2 billion, which constitutes 45% of its fish supply. The country produces 1.2 million tons of fish annually, with aquaculture contributing less than 300,000 tons of that total.