Norway-based seafood investor Bluefront Equity (Bluefront) has secured investments from the European Investment Fund, Novo Holdings and Esmée Fairbairn Foundation as it announces final close of its second impact fund, Bluefront Capital II.

The CEO of Bluefront, Kjetil Haga, said in a press release: “70 percent of the total amount comes from international investors. They view the seafood value chain as a key enabler to solve the global demand for healthy and sustainable proteins and consider the blue economy to be an attractive investment opportunity.”

Bluefront’s second fund, Bluefront Capital II, has in total secured investments in excess of USD 100 million, which is in line with its fundraising target. Recent commitments include approximately USD 35 million from the European Investment Fund (EIF), as well as Denmark-based Novo Holdings and UK-based Esmée Fairbairn Foundation, which both have committed undisclosed amounts. EIF is a specialist provider of risk finance to benefit small and medium-sized enterprises across Europe. Its shareholders are the European Investment Bank, the European Union, represented by the European Commission, and a wide range of public and private banks and financial institutions. Novo Holdings manages the Novo Nordisk Foundation’s assets to advance health and sustainability, and Esmée Fairbairn Foundation is a major UK impact investor focused on improving the natural world.

Earlier this year, Bluefront announced an investment from Builders Vision, an impact platform founded by Lukas Walton. Global Investment firm Cambridge Associates, which has USD 569 billion worth of assets under advisement/management, has also done a successful due diligence on Bluefront Capital II. The largest investors in Bluefront’s first fund have also committed to participate in Bluefront Capital II. They include Norwegian investors Havfonn, the Steensland group, 3S Invest, Klaveness Marine, TD Veen, Cubera, and some others.

In this sense, Simen Landmark, chief investment officer at Bluefront said: “Our first fund has performed strongly, which has been the catalyst for numerous repeat investments in our second fund. We are proud of the many new and returning quality investors that have put their trust in us.”

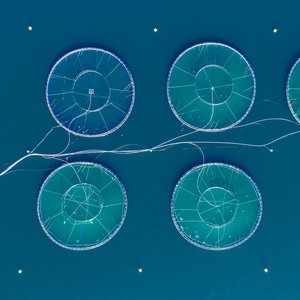

Bluefront Capital II has already made its first three investments:

- Cryogenetics: A provider of technology and services for the preservation of aquatic genes for the aquaculture industry.

- Horizon Software (previously FiiZK Digital): A company that drives impact for the seafood industry through digital solutions that optimize biological conditions and production for fish farmers.

- Piscada: which delivers software for process control and analytics to the fish farming industry.