U.S. Catfish prices must rise for industry to survive

High feed prices and low live-fish prices this year are forcing U.S. catfish producers to evaluate their operations and future plans, and many are calling it quits.

Catfish feed makes up about half of the production cost, and prices are more than $400 a ton this year, up from $250 a ton last year and in recent years. Live-fish prices have been as low as 70 cents a pound for catfish, but by July had reached 80 cents a pound. High fuel prices also mean it costs more to feed catfish, aerate ponds, and deliver fish to the processor.

“The increase in feed and fuel costs have dramatically affected the catfish farmer’s ability to cover his expenses and make a living,” said Terry Hanson, agricultural economist with the Mississippi State University Extension Service. “Farmers put their pencils to work and determined they might not be able to come out ahead.”

In response, some catfish producers reduced water acreage or shut down completely.

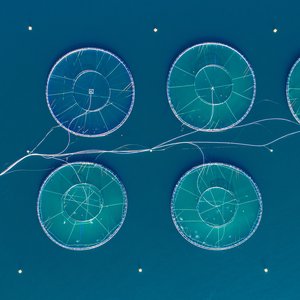

“Mississippi catfish acreage, which peaked in 2001 at 113,000 acres, decreased from 92,500 acres over the last half of 2007 to 80,400 acres by the end of July,” Hanson said. “There were 360 catfish operations as of July 1, 2007, and now there are 330 operations in Mississippi.”

Jim Steeby, Extension aquaculture specialist working from Humphreys County, said while acreage is down about 12 percent, the amount of feed used this year is down about 20 percent compared to last year.

“Most people haven’t stocked their ponds as high as before and aren’t feeding the maximum feeding regime each day that we typically do,” Steeby said. “We’re not looking at a maximum production scenario this year.”

Despite these numbers being down, processing is up about 21 percent.

“It looks like inventory is being cleared as a number of operations are going out of business,” Steeby said.

He said with low catfish prices, the market favors large, fully integrated catfish businesses.

“Those operations that are integrated and grow their own fingerlings and have their own processing plants and are major stockholders in the feed mills are the ones that will have the strongest chance for survival,” Steeby said.

But even these operations are struggling with market prices at only 80 cents a pound.

“It is dire for many people, and there are a number of producers getting out,” Steeby said. “The price of fish at the farm gate is going to have to rise to 90 cents to $1 a pound very soon to keep people in business.”

Unless market prices rise, Steeby predicted a deeper round of decreased catfish acreage in Mississippi and nationwide.

“We have an excellent product and a loyal customer base that won’t buy anything but U.S. pond-raised catfish, but we likely will need to get the pond and processor inventory below processor and wholesale demand levels,” Steeby said. “Enough growers will have to exit before prices and costs can match and we can survive.”