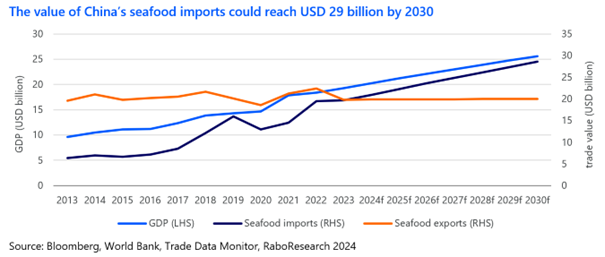

According to a recent RaboResearch report, China is poised to drive 40% of the global growth in seafood consumption by 2030. This tremendous growth, fueled by China’s economic prosperity, large population, and high seafood demand, could transform China into a USD 29 billion market for seafood imports. Higher-value seafood should benefit, driven by a growing upper-middle class and e-commerce expansion.

“China’s economic prosperity, coupled with its population of 1.4 billion consumers and a high affinity for seafood, positions it as the most promising growth market for seafood this decade,” said Novel Sharma, seafood analyst at RaboResearch. Chinese seafood consumption is expected to grow by 5.5 million metric tons through 2030, outstripping local supply. “We expect China to seek resources beyond its borders to ensure adequate supply and close the widening gap between demand and supply by the decade’s end.”

Both volume- and value-driven seafood demand growth expected

The forecast for China’s seafood demand for the remainder of the decade is a combination of volume- and value-driven growth. “We anticipate that urbanization, the growth of upper-middle-class consumer groups, and the expansion of e-commerce channels will drive a trend toward demand for higher-value seafood in the long term,” said Sharma.

“If this pivot to higher-value seafood continues, value-driven consumption growth will likely outpace volume-driven growth, with China potentially emerging as a USD 29 billion seafood import market by 2030, creating ample opportunities for global seafood exporters.”

Volume-based opportunities will still be significant, however. Domestic producers should benefit, as they typically focus on lower-value species and the mass market is likely to remain price-sensitive.

A USD 10 billion seafood import opportunity

RaboResearch expects China’s demand for seafood imports to grow by USD 10 billion by 2030. “This anticipated import growth could reshape the global seafood industry,” Sharma said. “High-value species such as salmon, lobster, crabs, and wild shrimp, of which China has limited to no domestic production, may see the largest gains. High-value species like farmed shrimp, for which China’s demand surpasses its production, also stand to benefit.”

Opportunities for seafood exports to China are ripe for Southeast Asian countries and India, particularly for shrimp, crabs, and marine fish. Central and Latin America, known for their competitive seafood exports, could unlock further growth, especially for high-value species like shrimp and salmon. Ecuador has already capitalized on China’s farmed shrimp demand in recent years.

“As China transitions to being the major global seafood buyer and price setter, the decisions it makes regarding seafood consumption and sourcing will have a global impact,” Sharma concluded. “It will be important for global exporters to monitor China’s evolving demand dynamics closely to identify potential untapped opportunities.”