According to a recent RaboResearch report, affordability and shifting trade dynamics are reshaping global seafood markets in 2025, as inflation and tariffs pressure consumer choices and supply chains.

Affordability and market dynamics

Affordability continues to be a crucial factor influencing seafood demand globally. In the US, high import tariffs may exacerbate inflation-driven affordability concerns, prompting consumers to opt for cheaper protein alternatives in price-sensitive retail segments.

Meanwhile, China’s seafood demand is expected to see modest improvement in 2025, supported by stimulus packages. However, persistent consumer price sensitivity may limit growth and lead to downtrading within the protein category.

Europe remains a strong market for seafood, with exporters likely to redirect trade from the US and China to this region.

Salmon: Growth momentum slows

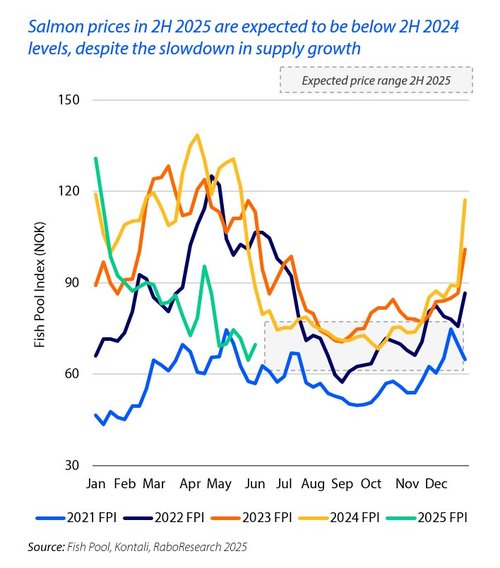

After experiencing robust growth in the first half of 2025, global salmon supply is anticipated to expand at a more moderate pace in the second half, with an expected 5% rise. Norway's production may slow due to elevated sea temperatures and potential biological risks, while Chile is set for a strong recovery, bolstered by healthier biomass levels.

“Salmon prices could face downward pressure, particularly in the US, where retail prices remain high despite easing wholesale prices,” explained Novel Sharma, seafood analyst at RaboResearch. “This scenario increases the risk of downtrading in price-sensitive segments, compounded by uncertainty surrounding US tariff policy.”

Shrimp: Navigating tariff and demand challenges

Shrimp prices showed recovery in the first half of 2025, driven by improved demand and retailer price adjustments. However, the outlook for the second half of the year remains uncertain due to trade and environmental challenges.

Ecuador’s early export surge may slow if US tariffs lead to demand contraction. Meanwhile, India approaches its summer production cycle cautiously amid high temperatures, rising costs, and tariff concerns.

“We expect shrimp supply growth to decelerate, with producers potentially delaying or reducing stocking in response to US tariffs,“ said Sharma.

Global trade flows are being reshaped, with Ecuador benefiting from lower US duties and India pivoting toward the EU market. Vietnam and Indonesia, on the other hand, face steeper US tariffs with limited options to redirect exports. Lower feed costs will aid industry profitability, partially offsetting tariff costs.

Fishmeal: Sustained supply growth

The global supply of fishmeal and fish oil is projected to maintain strong momentum in 2025, driven by Peru’s first-season anchovy quota of 3 million metric tons, the highest in seven years. A potential transition to La Niña later in the year could further enhance biomass health and support future quotas.

Despite declining soymeal prices, fishmeal’s sustained price premium suggests potential for price realignment in the coming months. Improved aquaculture production growth, particularly in salmon farming, is expected to boost demand for protein-rich feed ingredients, helping sustain fishmeal prices above long-term averages despite broader market pressures.