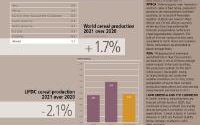

World cereal inventories in 2021/22 are expected to rise for the first time since 2017/18, according to FAO’s Crops prospects and food situation report. FAO’s forecast for global cereal production in 2021 has been lowered marginally in July compared to the previous month to 2,817 million tons but is still 1.7% (47.8 million tons) higher than in 2020 and would mark a new record high.

The modest month-on-month cutback principally concerns coarse grains, with global production now pegged at 1,513 million tons, 3 million tons below last month’s expectation. A sharp cut to the Brazilian maize production forecast accounts for the bulk of the expected global decline, as prolonged periods of dry weather have dragged down yield expectations.

These declines more than outweigh upward revisions made to maize production forecasts in China (mainland), the Russian Federation and Ukraine. Global wheat production prospects were also dented slightly this month, as the dry weather conditions in the Near East have cut back yield prospects. As a result, the 2021 world wheat output has been lowered by 1 million tons to 784.7 million tons, still 1.2% higher year on year.

The forecast of world cereal utilization in 2021/22 has been lowered by 15 million tons in July on a monthly basis to 2,810 million tons, nevertheless is still 1.5% higher than in 2020/21. The downward revision stems largely from lower-than-earlier-anticipated utilization of maize for animal feed in China (mainland), on expectations of much greater use of other feedstuffs, as well as for industrial purposes. Despite this downward revision, world total coarse grains utilization is forecast to increase by 0.9% from the 2020/21 level, reaching 1,510 million tons in 2021/22. By contrast, the 2021/22 global wheat utilization forecast has been lifted month on month to 780 million tons, now up 2.7% from the 2020/21 level. The monthly upward revision and the projected year-on-year increase in wheat utilization are both largely attributed to greater feed use of wheat driven by its price competitiveness relative to maize.

World cereal stocks by the close of seasons in 2021/22 are now forecast to rise above their opening levels for the first time since 2017/18 following a sharp upward revision of 24 million tons made in July to 836 million tons, up 2.4% from last year’s tight level. Higher maize stocks foreseen in China (mainland) account for the bulk of this month’s upward revision to world cereal inventories. Maize inventories in China (mainland) are now expected to reach 152 million tons, nearly 24 million tons higher than the previous forecast and up 3 million tons from their revised opening levels, marking the first year-on-year increase in six years. With this revision, stocks of coarse grains in 2021/22 are forecast to rise above their opening levels by 4% to 354 million tons. By contrast, 2021/22 wheat inventories have been lowered from the previous month but are still forecast to increase by 1.8% above their opening levels and reach a record 297 million tons, mostly reflecting anticipated build-ups in Australia, China (mainland), the European Union, India, Morocco and Ukraine.

Based on this month’s revisions to the forecasts of world cereal stocks and utilization, the global cereal stock-to-use ratio for 2021/22 is now expected to hover around 29%, hence on par with the 2020/21 level. FAO’s latest forecast for world trade in cereals in 2021/22 has been raised slightly since June and now stands at a record 472 million tons, representing an increase of 0.8% from the 2020/21 volume.

At nearly 235 million tons and unchanged from last month, trade in coarse grains in 2021/22 (July/June) is forecast to remain near its 2020/21 estimated level. Continued large maize purchases from China (mainland) are seen supporting a record maize trade level in 2021/22, while an expected expansion in sorghum trade is seen offsetting a likely fall in barley imports due to lower anticipated purchases by China (mainland), Morocco and Saudi Arabia. Greater import demand, expected from Algeria and Pakistan, has lifted FAO’s forecast for world wheat trade in 2021/22 to 189 million tons this month, an increase of 2.1% from 2020/21 mostly stemming from continued strong demand from several countries in Asia.

Download the report below.