American Capital Strategies Ltd.has invested $24.3 million to support the recapitalization of CPM Acquisition Corp., doing business as California Pellet Mill (“CPM”).

American Capital’s investment takes the form of a senior term loan and senior subordinated note with warrants. US Bank NA and Harris Bank provided a senior term loan and a revolving credit facility. The Compass Group International LLC, which acquired the company in 2001, is the equity sponsor.

“American Capital is backing a strong, global company that has captured dominant market shares worldwide with its outstanding reputation for reliability, high quality and excellent customer service,” said American Capital Principal Ken Jones. “With increasing worldwide meat and vegetable oil consumption, the demands for animal pelleting and oil extraction equipment are also on the rise. With eight international locations and an extensive installed base of its products, California Pellet Mill is well-positioned to supply the increasing demands of the global marketplace.”

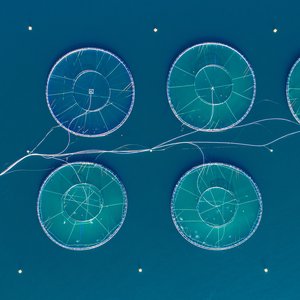

With world headquarters in Waterloo, IA, California Pellet Mill introduced the first commercially successful pellet mill for the production of animal feeds in 1931. The company now manufactures a complete line of machinery for the animal feed and oilseed extraction industries, including pellet mills, flaking equipment, spare parts, dies and shells under three recognized brand names – CPM, Roskamp and Champion. With over 300 employees and eight locations in North America, Europe, and Asia, California Pellet Mill has grown to be the largest pellet mill company in the world. The company’s customers include Perdue, Tyson Foods, Archer Daniels Midland and Cargill. Pictured at left is the one of CPM’s pellet mills, ideal for producing pellets for poultry and hog feed in very demanding environments.

“We are pleased to be partnering with American Capital to support the continued growth of California Pellet Mill as it expands its product line and attracts new clients both domestically and abroad,” said Joe Massoud, The Compass Group Managing Director. “Our partnership with American Capital, US Bank and Harris Bank strengthens our business and places us in a great position to pursue new opportunities and provide our valued customers the best products to meet their animal feed and soybean oil equipment needs,” said Ted Waitman, CPM President and CEO.

American Capital is a publicly traded buyout and mezzanine fund with capital resources exceeding $1.5 billion. American Capital is an equity partner in management and employee buyouts; invests in private equity sponsored buyouts, and provides capital directly to private and small public companies. American Capital provides senior debt, mezzanine debt and equity to fund growth, acquisitions and recapitalizations.

The Compass Group International, LLC is a private investment firm providing equity capital to small and middle market companies. The Compass Group provides funding for pursuit of growth opportunities, ownership changes and recapitalizations. The Compass Group acquires interests in a broad range of industries, with a preferred investment size of $4 million to $30 million.

Advertisement