Anpario Group sales for the past six months increased by 3% to GBP 16.5 million (USD 19 million) with the help of a strong recovery in Southeast Asia with sales growth mainly driven by the opening of economies post-COVID. Other notable performances were in Latin America, the United States, the Middle East and Africa. However, the EBITDA declined by 10% to GBP 3.0 million (USD 3.5 million) notwithstanding legal and professional costs regarding specific acquisition opportunities.

“Maintaining profitability at the same level as last year is going to be challenging in the context of the current macroeconomic and geopolitical headwinds,” said Richard Edwards, chief executive of Anpario. “Full-year performance will be determined by trading conditions and events throughout the remainder of the year. The group is supported by a strong balance sheet and further investment in our global sales channels will help deliver future organic growth.”

In America, the region grew sales by 9% with Latin America and the United States both delivering growth. There was a decline in South America due to weaker performances from Brazil and Chile.

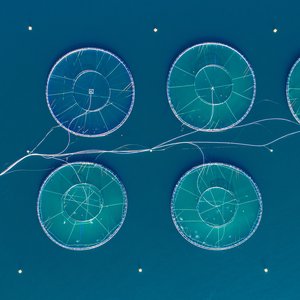

Latin America’s performance was strong due to increased demand for the Mastercube® natural pellet binder brand for aquafeed in Ecuador. In the South American region, both Brazil and Chile saw a decline in sales. Chile’s performance related to the phasing of orders of Oregon-Stim® for sea lice control. Both Argentina and Peru delivered improved performances compared to the same period last year when progress was affected by the pandemic.

The U.S. delivered sales growth due in part to a change in product mix where increased volumes of liquid Oregon-Stim® offset declines in the powder version and mycotoxin binder sales.

In Asia, sales increased by 7%. The reopening of the economy in Southeast Asia helped the region deliver significant sales growth. Strong performances were observed in the Philippines and Malaysia. The mycotoxin binder range did particularly well because, as the region is an importer of grain, high prices typically mean feed mills switch to lower quality grain and use more mycotoxin binder to protect the animal from harmful toxins which may be present in the poorer quality raw material.

China experienced a decline in sales with lower volumes of both Oregon-Stim® because of reduced meat protein consumption and disruption to logistics during COVID-19 lockdown periods.

Sales across Australasia, which covers Australia, New Zealand, and Papua New Guinea, declined with demand generally down across most products as farmers were under pressure from high input and freight costs.

In the Middle East, Africa, and India sales grew by 12%. Strong performances from Iraq, Egypt, and Saudi Arabia were observed compared to the first six months of the year before. Sales of enzymes, mycotoxin binders, and pellet binders contributed to the sale’s improvement.

In Europe, sales declined by 16% compared to the same period the year before. Sales to Russia and Belarus are down GBP 0.1 million (USD 0.12 million) due to the decision to cease trading with these countries. Smaller territories, such as Estonia, Bulgaria, Austria, and Denmark, delivered growth which helped limit the overall impact.