South Asia, home to approximately 2.08 billion people, is the most populous region in the world. This dense population drives strong demand for animal protein, fueling rapid growth in livestock—particularly poultry—and aquaculture sectors. Consequently, the production of animal feed has surged, with soybeans playing a central role due to their high nutritional value.

To meet this demand, the region’s soybean crushing industry has expanded, particularly in Bangladesh, making it among the world's top importers of whole soybeans. The region is a significant market opportunity for U.S. Soy, which has been actively engaged in the region since 1996 through the U.S. Soybean Export Council (USSEC).

Recently, USSEC hosted the Aqua Tech Talks in Colombo, Sri Lanka, an event aimed at sharing insights into fish and shrimp nutrition and best practices in aquafeed production. These discussions highlighted the use of high-quality ingredients, including U.S. Soy, to optimize feed performance.

Country snapshots

Bangladesh has emerged as one of the most successful markets for U.S. Soy in the region. With a robust soybean crushing industry, the country benefits from long-standing partnerships with USSEC and initiatives like the Soy Excellence Center and Right To Protein. “We're helping Bangladesh realize its potential for protein consumption,” Kevin Roepke, Regional Director – South Asia & Sub-Saharan Africa, USSEC, told Aquafeed.com during the Aqua Tech Talks.

Pakistan relies heavily on imported feed ingredients due to minimal local soybean production. The USDA projects Pakistan’s soybean imports to rise to 2 million metric tons in the upcoming crop year. Notably, U.S. soybean exports to Pakistan resumed in February 2025 after a two-year ban on genetically engineered (GM) imports, with 65,000 tons shipped that month (USDA), revitalizing the country's feed and food sectors.

Sri Lanka is a key importer of U.S. soybean meal, which is primarily used for animal feed. In 2023, it imported about $101 million worth of U.S. soybean meal and became the first South Asian country to adopt the “Fed with Sustainable U.S. Soy” label. New Anthoney's, a leading local poultry producer, was the first global adopter of the label, followed by companies like Jaya Farms, Pussalla Meat Producers, and more.

India, the fourth-largest feed-producing country globally, grows soy domestically but has recently turned into a net soybean importer due to an increase in demand from the animal feed industry. However, its soybean yield is among the lowest in the world, under 1 metric ton per hectare, compared to 3.4 in the U.S. (USDA), leading to an opportunity for imported high-quality ingredients.

India has historically restricted imports of genetically modified (GM) soybeans and soybean meal. As part of ongoing trade negotiations, the U.S. has requested that India ease restrictions on GM crop imports. Projections indicate that India’s soybean meal imports will rise from 1.4 million metric tons of non-GM and 1.4 million metric tons of GM in the 2020s to 12.8 million metric tons of non-GM and 9.3 million metric tons of GM by 2050, which means an important business opportunity for U.S. Soy.

Regional challenges and U.S. Soy’s role

South Asia's livestock and aquaculture sectors offer great opportunities for U.S. Soy but also face several challenges, such as the cost of production, competitiveness, and farmgate prices. However, USSEC highlights that U.S. Soy addresses many of these issues by offering superior quality. “Compared to other origins like Brazil, U.S. Soy features lower moisture, reduced heat damage and higher digestible protein,” said Dr. Morgan Cheatham, Manager Animal & Aquaculture, USSEC. “Moreover, although Brazilian soy production has increased in the past few years, its infrastructure has not evolved at the same rate, adding other risks, such as mycotoxins.”

“Feed producers often have very limited to no control over input or product prices, but they can manage production efficiency and feed quality, areas where U.S. Soy delivers consistent, reliable performance to de-risk their operations,” Cheatham said.

Besides, South Asia faces significant labor market challenges, including limited job opportunities, low wages, a large youth population not in education or training, and a high proportion of vulnerable employment. USSEC also invests in human capital through the Soy Excellence Center (SEC), offering education and technical training tailored to early- and mid-career professionals. The program focuses on providing training and knowledge exchange for professionals in the soy and protein industries, particularly in emerging markets like South Asia.

“Our SECs are targeting entry level to mid-career professionals - the future company leaders,” Roepke said. “By enhancing management capabilities, these programs help companies improve operations and expand efficiently.”

Sustainability is of growing importance, especially for export-driven aquaculture industries in South Asian nations. “U.S. Soy boasts the lowest carbon footprint among major producers, thanks to efficient production methods and minimal deforestation. U.S. soybean farmers are committed to the 2030 sustainability goals centered on soil health, energy efficiency, and reducing greenhouse gas emissions,” Stan Born, a soybean and corn farmer and past chairman, USSEC, said.

USSEC also promotes certifications like the “Sustainable U.S. Soy” label and the U.S. Soy Sustainability Assurance Protocol (SSAP), which help buyers support environmentally responsible sourcing.

“Last year, 71% of our shipments went to processors with a U.S. Soy sustainability certificate. These certificates can be passed along up to four times in the value chain,” Born said.

“When you commit to sustainability and programs like the SSAP, you unlock benefits you might not expect,” added Roepke. “It’s not just good for your brand or your consumers—it also helps you attract and retain world-class talent.”

Kevin Roepke, Regional Director – South Asia & Sub-Saharan Africa, USSEC. Credits: USSEC

Bangladesh, a regional success story

Bangladesh is the largest aquaculture market for U.S. Soy in South Asia. The country is one of the most densely populated in the world and has been prioritizing the agricultural industry. “They have an open import policy with 0% duties on soybeans and soybean meal and a large-scale, world-class soybean processing industry. They are very diversified integrators, as well as very well-managed and well-capitalized companies. They also have natural competitive advantages with water and coastline,” Roepke said. “They are also savvy buyers, willing to pay a premium for U.S. Soy’s consistency, reliability, and digestibility.”

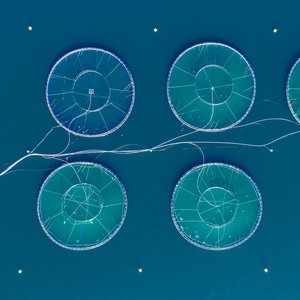

The country currently operates 33 in-pond raceway systems (IPRS). The system is an advanced approach to pond aquaculture that combines the management benefits of confining fish in a small portion of the pond with the production capacity of a flowing water system.

“IPRS provides advantages because fish are confined, easily observable and fed based on response more efficiently than in an open pond. Intensive production systems such as IPRS require precision nutrition, so you have to make sure you are using appropriately formulated feeds,” Cheatham said.

Aquaculture: Innovation, risk and opportunity

South Asia is a powerhouse in global aquaculture production, which faces numerous challenges, including disease, regulatory hurdles, labor shortages, climate change, and most critically, production risk, driven largely by feed efficiency. Feed costs account for 55–70% of operating costs in aquaculture, making feed quality a key factor in profitability and risk management.

“Soy is the most widely used protein in aquafeeds, thanks to its high digestibility, amino acid profile, availability, and lower carbon footprint compared to fishmeal, making it a powerful tool to reduce production risk,” Cheatham said. “U.S. Soy isn't just an ingredient—it's a strategic tool in managing risk, improving efficiency, and ensuring the sustainable growth of the global aquaculture industry.”

At the Aqua Tech Talks, several research trials were presented, highlighting the importance of high-quality ingredients in aquaculture performance. For instance, a research and economic analysis by Wittaya Aqua showed greater profitability and lower carbon footprint for tilapia producers who choose U.S. soybeans over other origins. Fillet yield and growth were also increased with U.S. soybean meal.

It was also highlighted that new aquaculture technology solutions are also key for increased efficiency and sustainability, such as acoustic shrimp feeders that have already demonstrated their positive impact in farms in Ecuador and elsewhere. “These technologies are making a difference in farms that are looking to intensify, improve feed efficiency and scale up their production. However, that needs to be accompanied by high-quality aquafeeds,” Cheatham said.

However, not all South Asian farms can afford these costly technologies. “Basic additions like aeration can significantly improve productivity in semi-intensive systems without requiring huge capital investments,” Cheatham advised.

With consumers increasingly demanding sustainable products, aquaculture also needs to move towards sustainability. “It requires integrating diet design, ingredient sourcing, and feeding practices to minimize emissions and waste while maintaining productivity. Early intervention is critical as the sector grows in this region, and feed formulation plays a central role in meeting sustainability and certification demands,” said Lukas Manomaitis, Technical Director Aquaculture Southeast Asia and Oceania at USSEC.

“When it comes to shrimp produced in South Asia, the emission intensities are high due to their high production levels. Therefore, we need to tailor the strategies to mitigate emissions differently and use low-carbon-footprint ingredients, such as U.S. soybean meal, also vital for reducing waste,” said Harsha Galkanda-Arachchige, Data Modeling & R&D Specialist, Wittaya Aqua.

Morgan Cheatham, Manager Animal & Aquaculture, USSEC. Credits: Aquafeed.com

Managing complex supply chains

South Asia’s diverse local ingredient sources add complexity to feed formulation.

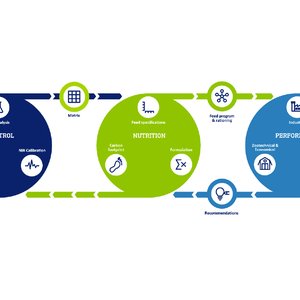

“More ingredients mean less control. That also increases operational complexity at the feed mill. Furthermore, some of these locally sourced ingredients do not have a consistent supply chain and feed formulators don’t always know the nutrient specifications. With U.S. soy, they have a consistent product, it's of high quality, easy to manage, suitable for a variety of species, and increases operational efficiency,” Cheatham said.

“With a consistent, reliable supply like U.S. Soy, one of the greatest competitive advantages is the minimization of safety margins in feed formulation,” Roepke said. “U.S. Soy is very consistent and reliable. Nutritionally, it has a very low safety margin use. As a result, you don't need to add more protein than needed. This results in economic value at the feed mill level but also in resource use, efficiency, supply chain, and increased efficiencies at the farm level and lower nutrient leaching.”

Innovation and capacity expansion

Growing global demand for biofuels is driving U.S. plans to expand soybean crushing capacity, which will increase soybean meal supply. “With aquaculture being one of the leading users of soybean meal, the increased crushing capacity from the U.S. would be a total paradigm shift in the economics of where soybean meal origins are sourced from,” Roepke said. “This increase could also be beneficial to feed producers in countries that lack crush capacity.”

Soybean also produces a variety of value-added products. “There are soy protein concentrates, which are used fairly widely, especially in higher-value species like salmon or other marine species, and fermented soybean meal, which is also used in the production of several marine species such as Mediterranean seabass. In South Asia, there is potential for increased use of these products as marine finfish culture grows,” Cheatham said.

“For those that are going to process soybean meal into value-added ingredients and that are ultimately going to sell for a premium, they need to start using a high-quality raw material, soybean meal or soybeans, and U.S. Soy is a really good fit for this industry and for anyone that is looking to produce these products to support the aquaculture world,” Roepke.

Several plants across Europe and Asia are already using U.S. soybean meal, and USSEC hopes that increased U.S. supply will further encourage investment in emerging processing technologies.

The future

“The future of aquaculture in South Asia is bright,” Roepke said. “High-quality water, abundant labor, and access to ingredients position the region well for growth. Aquaculture also supports rural development, helping manage urban migration and stimulate local economies.”

“U.S. Soy is more than a product—it’s a partner,” Cheatham concluded. “Whether you're a nutritionist, marketer, or feed mill manager, we help de-risk your business, enhance sustainability, and add value at every level of the supply chain. U.S. Soy is here to help build a resilient, thriving aquaculture industry.”