In 2025, Thai Union Feedmill Public Company Limited (TFM) is investing over THB 300 million (USD 9.1 million) to enhance feed production efficiency and move toward Industry 4.0 standards. This includes upgrading shrimp and fish feed production lines, which account for 60% of total production capacity. The upgrades are expected to be completed and operational by August 2025.

These projects aim to enhance production efficiency and feed quality consistency. The company also aims to reduce production costs by upgrading machinery to modern, precise automated systems and incorporating energy-saving technologies.

The investment includes four production lines: two fish feed lines at the Mahachai plant and two shrimp feed lines at the Ranot plant. Three lines involve changing existing machinery to modern automation, while one new line will expand shrimp feed capacity using the same automation technology. These upgrades will cover over 60% of total production capacity, improving efficiency, reducing costs, and advancing TFM toward smart manufacturing under Industry 4.0.

Record-breaking Q2 2025 performance

TFM reported its Q2 2025 performance, achieving a record-breaking net profit of THB 194 million (USD 5.9 million), up 49.7% year-over-year. Total sales reached THB 1,476 million (USD 44.9 million), a 13.8% increase, driven by continued growth in domestic shrimp and fish feed. Gross profit margin hit a new high of 22.9%, marking six consecutive quarters of strong growth.

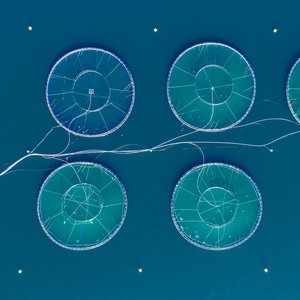

Peerasak Boonmechote, CEO of Thai Union Feedmill PCL, stated that the company achieved its highest-ever sales and net profit since listing on the Stock Exchange of Thailand. Sales grew 13.8% year-over-year, mainly due to robust domestic market expansion. Shrimp feeds generated THB 929 million (USD 28.3 million) in sales, up 13.8%, driven by increased market share through new customer acquisition and expansion of existing customer bases. Fish feed sales reached THB 455 million (USD 13.8 million), up 18.2%, supported by a 29.1% increase in seabass feed volume and a 16.1% rise in other fish feed types.

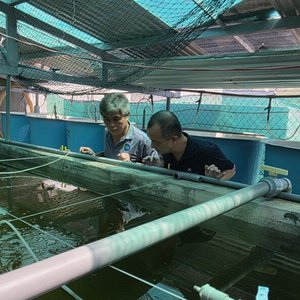

“Shrimp feed growth has been supported by consistent high-quality feed, which has positively impacted shrimp farming results and increased feed usage. Additionally, expanding the customer base and collaborating with shrimp hatchery partners has helped TFM gain market share. Domestic consumption and exports continue to drive demand for shrimp feed,” the company said.

For seabass feed, TFM has expanded its customer base, particularly in central Thailand, leading to steady sales growth. The seabass market demands feed that supports high-quality fish meat production, with a focus on reducing antibiotic use, minimizing residues, and enhancing nutritional value for optimal growth. To ensure long-term sustainable growth, TFM emphasizes innovation, sustainability, and feed efficiency.

TFM also maintained a strong financial position through effective financial management, with a low interest-bearing debt-to-equity ratio of just 0.08. For the first half of 2025, the company reported sales of THB 2,707 million, up 6.3%, and net profit of THB 326 million, up 39.5% year-over-year.

Peerasak added that TFM expects 2025 revenue to grow 7-9%, driven by continued growth in shrimp and fish feed businesses. The company aims to maintain its gross profit margin through portfolio management, production efficiency improvements, and effective raw material cost control. It also plans to manage SG&A expenses relative to sales to support long-term business growth.

TFM is actively pursuing its long-term growth plan to achieve THB 10 billion (USD 304 million) in total revenue by 2030, representing a compound annual growth rate (CAGR) of approximately 11%. To support this growth, the company continues to invest in Thailand and Indonesia, focusing on expanding production capacity, enhancing operational efficiency, and upgrading manufacturing technology. TFM is also open to new investment opportunities aligned with its sustainable growth strategy, including product development, market expansion, and strategic partnerships.