In 2017, Bühler raised CHF 420 million through the issue of a dual-tranche Swiss franc-denominated senior bond (CHF 180 million Tranche A, USD 194 million, and CHF 240 million Tranche B, USD 259 million). The fund, which aimed to accelerate the company’s growth plans and expand its investment and acquisition capabilities, was the first time in its 160-year history that Bühler raised capital on the financial markets.

The repayment of the bond is an important milestone and was achieved while the company continued to fully execute its investment strategy, focusing on innovations, research and training centers, and new partnerships.

The second tranche of the bond of CHF 240 million (USD 259 million) is due in December 2026. The bond is listed on the SIX Swiss Exchange.

Despite the uncertain and volatile environment faced in the last few years, including the challenges posed by the COVID-19 pandemic, Bühler was able to further strengthen its financial position and liquidity.

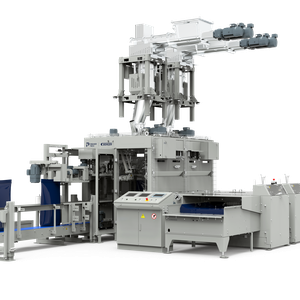

The decision to raise capital on the financial markets in 2017, enabled Bühler to finance its growth by investing in its global production and innovation network and acquiring the Austrian Haas Group. The combined solution and product portfolio of Bühler and Haas has since proven to be a major competitive advantage.

“The proceeds from the bond allowed us to successfully accomplish the Haas acquisition, to continue the modernization of our production sites, to build the CUBIC innovation campus in Uzwil, and to expand our global sales and services network,” said Stefan Scheiber, Bühler Group’s CEO.

“Thanks to our diligent liquidity management we were able to repay the first tranche of the bond and at the same time retain our full strategic flexibility for growth and innovation,” said Mark Macus, Bühler Group’s CFO.