Agrifoodtech startup, MicroHarvest, partnered with Simon Capital to strengthen the teams’ operational know-how within the food and production space and bring in additional funds to fuel the company’s growth.

After successfully closing a EUR 8.5 million Series A financing round last September, led by Astanor Ventures, FoodLabs, Happiness Capital and Faber, MicroHarvest has raised EUR 1.5 million from new investment partner Simon Capital.

“Choosing the partnership with Simon Capital will bring a significant long-term edge to the growth of MicroHarvest. Simon Capital doesn’t just bring extra funding: through them, we gain access to an incredibly experienced team who understands the ins and outs of a manufacturing company in the food and beverage space. We share a result-oriented mindset and are purpose-driven, with the bold ambition of building a resilient food system. I believe this combination of operational and cultural match is what makes this partnership a critical milestone for our company’s success,” said Katelijne Bekers, MicroHarvest co-founder and CEO.

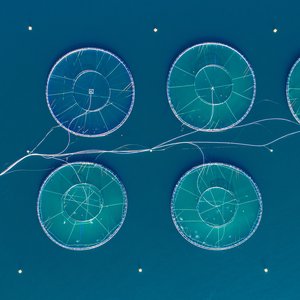

The investment, which will bring the total funding into the Hamburg-and-Lisbon-based startup to over EUR 10 million, will allow the company to work towards key commercialization milestones. As part of its efforts to enter the market by the end of 2023, the company is building a pilot plant at its new location in Lisbon. This plant will enable them to produce prototypes and accelerate research, as production is being ramped up together with a contract manufacturing partner.

“We are excited to join the MicroHarvest team on their mission to combine best-in-class research know-how and operational expertise for reshaping the B2B protein ingredients industry, by unlocking the full potential of microorganisms. It is impressive to see what the team has built up in the last months on its path to improving the resilience of tomorrow’s food system and, in addition, driving impact for more sustainable consumption. Simon Capital is looking forward to working closely together with the team and a renowned set of investors,” said Friedrich Droste, managing partner at Simon Capital.

MicroHarvest operates within the rapidly accelerating sector of fermentation-enabled protein, which saw an investment increase of 37% in Europe in 2022, according to The Good Food Institute data. The company's proprietary technology, based on biomass fermentation, enables production at a speed and efficiency that far exceeds other existing approaches. The result is quality protein ingredients containing over 60% raw protein, which can be produced in 24 hours from input to output, requiring a fraction of the water and land needed for other commercially available alternatives. Applications along the whole protein value chain of B2B ingredients are manifold, ranging from animal feed to direct application in food and pet food.

In its first two years of operation, MicroHarvest has already reached remarkable milestones, including receiving BloombergNEF Pioneers Awards for their low-carbon response to alternative protein and demonstrating a significant potential of speed to market.